Planning retirement means understanding how timing affects your income. Retirement age changes influence monthly amounts, shaping what you’ll receive throughout the years ahead.

Every year of difference matters when deciding the right time to retire. Small shifts in timing lead to real differences in benefits, making informed planning absolutely essential.

This is a guide by Insiderbits created to simplify retirement planning. Keep reading to learn how choices affect your future, check your retirement age and maximize your benefits.

Correlato: Retirement Planning 101: Best Apps to Prepare Financially

Retirement age changes in 2025 explained

Planning for the future means paying attention to when benefits begin. Updates in 2025 shift that timeline, and those changes directly influence the amount people will receive.

The adjustment continues a gradual move toward a later full age for claiming. This shift is especially important for anyone considering when to stop working.

For people approaching this stage, retirement age changes highlight why timing is so important. Knowing the rules now helps set realistic expectations about monthly checks.

How rising full retirement age shifts monthly payments

The full retirement age is 67 for anyone born in 1960 or later. That means younger workers face stricter timelines than earlier generations.

Claiming benefits at 62, the earliest age allowed, means receiving about 30 percent less per month than waiting until the full retirement age.

On the other hand, holding off until age 70 results in larger checks. Delaying boosts monthly payments by about 8 percent for each year past 67.

Why each year matters when deciding to claim

The Social Security formula is designed so payments grow the longer someone waits to start. Even a single year of difference creates measurable changes in lifetime income.

For example, someone due $1,000 at full age would receive about $700 monthly at 62. That smaller amount lasts permanently, regardless of future work history.

This is where retirement age changes matter. Choosing 68 instead of 67 raises payments by about 8 percent, showing how each year directly impacts financial stability.

The difference between early and delayed retirement credits

Early claiming at 62 permanently reduces benefits. The reduction is steepest for those born in 1960 or later, reaching nearly one-third less than the full amount.

Delayed retirement credits add value instead. Each year waited beyond 67 grows payments until 70, with a maximum increase of 24 percent compared to claiming at full age.

Seen through the lens of retirement age changes, this difference highlights why deciding when to start matters. Timing alone can mean hundreds of extra dollars monthly.

Step-by-step: how to check your estimated benefits

Checking estimated benefits is one of the most important steps in planning. The Social Security Administration provides clear online tools that show expected monthly income.

These tools use your work history and current earnings record to project future payments. Knowing what to expect helps build confidence and allows for smarter financial choices.

By understanding the process, people can see how retirement age changes influence their future payments. Plan smarter — see your SSA estimate today.

Locating your Social Security Statement online

The quickest way to view your statement is through the official SSA website. By creating a “my Social Security” account, you gain direct access instantly.

Your account provides a downloadable statement that shows your entire earnings history, credits, and estimates of future benefits at different ages, all presented in a simple format.

This resource is free, secure, and updated regularly. Having it on hand allows you to check progress, confirm details, and plan around accurate government-provided numbers.

Understanding the numbers on your estimate

Each statement shows projected monthly income at three key points: early eligibility at 62, full retirement age, and delayed benefits at 70 with credits included.

The figures are based on lifetime earnings reported to the SSA. This means accurate income records are essential, since errors can lead to smaller payments over time.

When viewed with retirement age changes in mind, these numbers reveal how timing shifts impact outcomes. Choosing carefully ensures the benefits align with long-term financial goals.

Common mistakes to avoid when reviewing your record

- Not checking earnings reports: unnoticed mistakes in your wage history may reduce benefits permanently, so confirm every year’s reported income carefully;

- Assuming projections are fixed: estimates change with updated earnings and policy adjustments, so treat them as guides rather than guaranteed numbers for the future;

- Forgetting cost-of-living adjustments: benefits rise with inflation, so ignoring these increases gives an incomplete view of what monthly payments might actually provide;

- Delaying record reviews: postponing checks for too long risks leaving errors uncorrected, creating complications and stress when benefits are eventually claimed.

Correlato: Controllate il vostro futuro: Come utilizzare l'App Empower Retirement

Tools to plan the best time to retire

Choosing when to leave the workforce involves more than just a date. Reliable tools help people calculate outcomes and shape decisions about long-term financial stability.

Government platforms provide calculators that estimate monthly checks. They reflect personal earnings history and include adjustments tied to retirement age changes.

Private financial sites also offer retirement planning simulations. They factor in investments, savings, and lifestyle needs, giving users a view beyond official Social Security estimates.

SSA calculators that project future benefits

The SSA’s Retirement Estimator uses your actual earnings record to calculate personalized results. It offers projections based on different claiming ages, helping clarify the impact of timing.

Other calculators, such as Quick Calculator o Detailed Calculator, allow you to test hypothetical scenarios. They are useful for understanding how income changes might alter benefits.

Because these tools are official, they rely on verified data from the SSA. That makes them reliable for setting expectations and planning around accurate government information.

Comparing scenarios for early, full, and delayed retirement

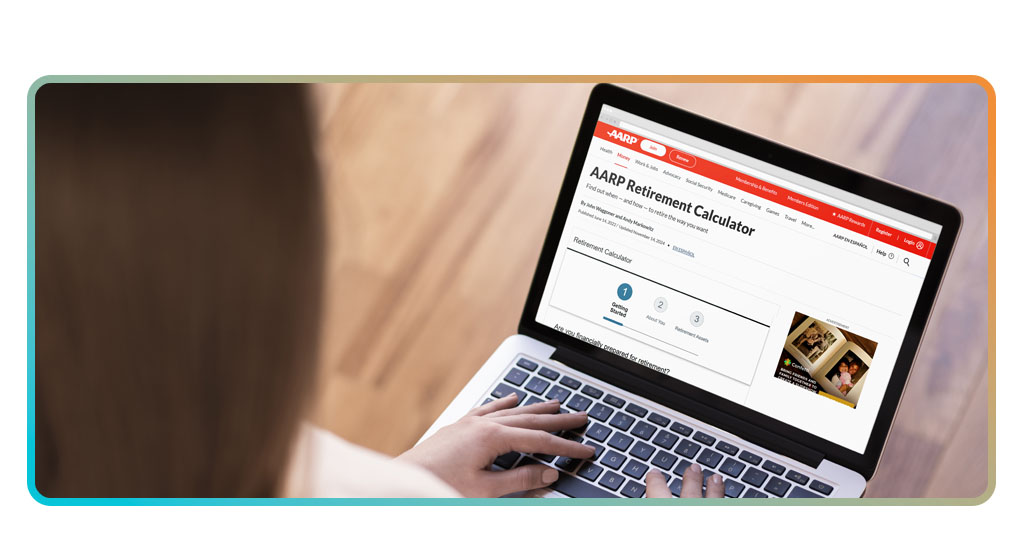

The official SSA Retirement Estimator lets users see the difference between claiming at 62, full age at 67, and waiting until 70 for delayed credits.

AARP’s free Social Security Benefits Calculator is another trusted option. It compares outcomes across ages and includes spousal benefits, making it a strong tool for household planning.

Fidelity also provides retirement planners that integrate Social Security projections with personal savings. These comparisons show the financial trade-offs more clearly than paper statements.

Using online simulations to align with personal goals

Online simulations, like those from AARP e Fedeltà, allow people to enter savings, expenses, and expectations. They project whether personal goals match anticipated Social Security.

These tools show how long savings may last when combined with benefits. By adjusting assumptions, users can test how different retirement dates affect financial security.

Many simulations end by highlighting how monthly benefits interact with private assets. They remind users to account for retirement age changes when finalizing plans and timelines.

Where to access retirement info online

Planning for the future is easier with reliable online resources. Digital platforms provide official statements, calculators, and updates that help people understand how benefits will work.

The Social Security Administration’s sito web is the most direct place to start. It offers secure accounts where users can track benefits and monitor their personal earnings history.

Other organizations also publish helpful guides and estimators. By combining these official tools with additional planning platforms, people gain a complete picture of what to expect financially.

Navigating the SSA retirement portal with ease

The SSA portal explains retirement age changes clearly and gives users personalized benefit estimates. Creating an account grants access to statements, calculators, and more.

Navigation is simple, with a dashboard that highlights key tools such as the Retirement Estimator and calculators for planning based on earnings and projected claiming dates.

Users also receive reminders about updates and can correct errors in their earnings record. This approach ensures payments reflect accurate information when benefits eventually begin.

Trusted sources beyond the official website

Nonprofit groups explain Social Security programs in plain language, helping people understand retirement age changes alongside practical planning strategies for managing income.

AARP offers an interactive calculator that compares claiming ages. Companies like Fidelity and Vanguard publish guides integrating Social Security estimates with retirement savings.

Government sites like the Consumer Financial Protection Bureau provide simple articles about retirement rights and benefits. These complement the SSA portal and improve financial literacy.

Why checking regularly keeps plans on track

Your statement changes yearly as income is reported. Regular reviews prevent errors from lingering, making sure that calculations reflect real contributions and lead to correct amounts.

This routine also allows people to adjust their planning as life circumstances change. Marital status, income shifts, or new health considerations can all influence future choices.

Consistency in reviewing records matters most when retirement age changes affect eligibility. Checking often ensures that your plans remain aligned with personal goals and expectations.

Correlato: Social Security Changes: What Your New Benefits Look Like

Retirement choices shape tomorrow, so decide with clarity

The age you choose to start benefits changes more than numbers. Good planning gives peace of mind and helps you picture a steady future ahead.

Insiderbits created this guide to explain how retirement age changes affect monthly income and to share tools that make preparing for later life far easier.

Stay with Insiderbits for more practical guides written for real people. Our articles give useful tips that keep important decisions clear, approachable, and easier to put into action.