Do you really understand your bank statement? If numbers and charges still seem confusing, you’re not alone. Clear financial literacy tools help make sense of everyday decisions.

Knowing how to separate bills, plan goals, and spot suspicious activity builds real awareness. Digital tools can help turn lessons into habits that support real-life choices.

This is a guide by Idées reçues created to support adults learning to manage money. Keep reading to get the financial skills that protect and empower you.

En rapport : Apps that help you split bills with roommates automatically

Financial literacy for adults made simple

Some adults never had the chance to learn how money works. The good news is it’s never too late to build useful habits that support real financial decisions.

Learning about saving, budgeting, or bills doesn’t require long hours or complex classes. Simple, practical tools break it down into small lessons that actually stick with time.

Many apps aim to help, but few make financial literacy feel doable. When the content connects to your reality, that’s when you begin to understand money on your terms.

Learning money skills doesn’t have to be hard

Plenty of people avoid financial topics out of fear they’ll make mistakes. But learning just one small thing a day can already change how money is handled.

It starts with awareness. Noticing where your money goes gives insight into what’s helping or holding you back. Good learning tools help you track and adjust without pressure.

Apps like Money Masters offer a bite-sized way to build new money habits. You don’t need a degree to make smart changes that support real-life goals.

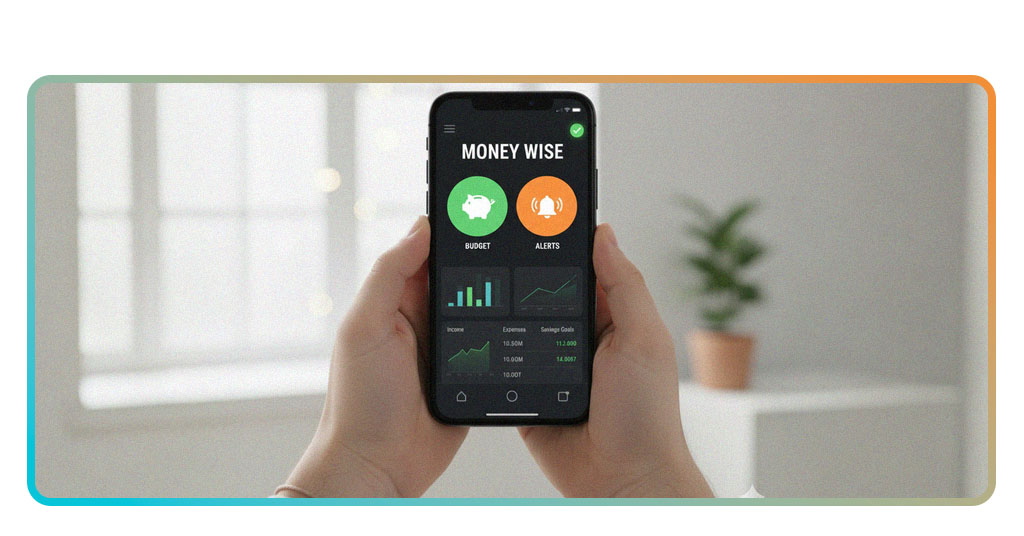

Meet Money Masters: the app that makes learning easy

Not every app keeps it simple. This one delivers quick five-minute lessons and useful examples that feel relevant whether you’re budgeting your groceries or planning for rent.

Its structure rewards learning without pressure. As you finish topics, you earn coins and climb leaderboards. It’s finance that fits into everyday life and celebrates real progress.

Built around real needs, the app helps users develop financial literacy by explaining key topics like spending, saving, loans, and investing without extra steps or unnecessary complexity.

4.2/5

How Money Masters makes finance easier for adults

The app doesn’t talk down to users or fill lessons with complex terms. Everything is written in accessible language that matches the real-world situations adults face today.

Lessons are short, focused, and mobile-friendly. You can learn while waiting in line or riding the bus. No extra books or long explanations needed to understand the basics.

Users who’ve struggled with money say the app finally made financial literacy feel possible. It teaches one concept at a time without rushing or assuming what you already know.

Features that help you manage money better

Good tools don’t just give information. They help you build habits that last. Money Masters keeps things short and focused so you won’t feel overwhelmed or lost.

Each feature was built for real life. Whether you’re on the bus or between chores, there’s always time to learn something that helps with your next money move.

The app doesn’t just explain. It connects actions to outcomes so you see how financial literacy builds over time and shapes the way you handle decisions and expenses.

Quick lessons that fit into your daily schedule

Time matters. Money Masters lessons take just five minutes and still manage to teach you something useful before work, after dinner, or while waiting in line.

The content adapts to your progress. If you’re new to budgeting, you won’t be pushed into loans or investing. Lessons grow with you and your personal pace.

You don’t need to block off study time. One short module each day helps you stay on track without interrupting your routine or making things feel like a chore.

Games and quizzes that reward learning progress

Learning feels better when it’s interactive. Money Masters adds small challenges that make each lesson more engaging and give users something fun to work toward every week.

Quizzes help lock in what you’ve learned. And because scores count toward gift cards and leaderboards, there’s motivation to keep going even when you’re not in the mood.

This approach to financial literacy turns passive learning into active wins. You’re not just watching a video. You’re playing, answering, and earning rewards that reflect your progress.

Real examples that show how to apply financial tips

Lessons only work if they match reality. That’s why this app includes examples tied to real situations like splitting bills, avoiding scams, or planning for a trip.

Scenarios are explained in everyday terms. No need to decode technical words or search for hidden meanings. The tips match what people actually go through with their money.

By grounding financial literacy in examples like rent, food, or bills, the app makes sure what you learn feels useful from the very first lesson you complete.

En rapport : The Must-Have Apps for Budgeting in 2025

Step-by-step: learn budgeting and avoid scams

Learning to manage money means knowing where it goes. With guided steps, you learn to track spending, plan smarter, and reduce financial surprises that interrupt your daily life.

Scams target people who feel unsure. Building knowledge around spending habits and bank statements makes you quicker to spot red flags before they turn into real losses.

Money Masters offers practical ways to develop routines that improve budgeting. This kind of support makes money management easier to understand and more useful in daily life.

Separate your essential and non-essential expenses

A good budget starts with sorting needs from wants. Food, rent, and utilities come first. Subscriptions, takeout, and extras can be adjusted once the essentials are covered.

This habit supports long-term financial literacy. When you know what’s necessary, you’re less likely to overspend and more likely to make room for things that truly matter.

Set simple monthly goals you can actually achieve

Start with one goal that matches your current budget. Saving twenty dollars or tracking all spending for a week is more helpful than chasing something unrealistic or vague.

Small goals work because they give quick results. Once you complete one, it’s easier to keep going without getting stuck or feeling like it’s not working.

Review your statements line by line

Learning to read your full bank statement gives you control. Line-by-line review helps you notice charges, avoid missed fees, and understand what’s happening with your money daily.

This builds financial literacy over time. You get used to how statements are structured and learn to double-check transactions that don’t look familiar or expected.

Spot and report suspicious charges immediately

Suspicious activity isn’t always obvious. Small changes, new fees, or strange purchases might be the first sign. Acting early helps stop problems before they grow or repeat.

Most banks let you report issues directly through their app. The faster you respond, the better your chances of protecting your account and preventing further unauthorized use.

Where to download the app

Money Masters is available for free on Android and iOS, making it easy to start learning without hurdles. Just search in Google Play or the App Store to begin.

The app was designed for adults who want to improve financial literacy without complicated tools. Downloading through official platforms ensures a reliable experience from the start.

Once installed, everything you need is already there. Lessons are ready, guidance is clear, and progress begins with your first tap. Download now and learn to manage your money today.

Quick setup tips for beginners

Installing Money Masters takes just a moment, but a quick look at permissions and settings helps avoid surprises and gets the lessons flowing without interruptions.

- Enable automatic updates: this keeps the app current so you always have the latest features and security fixes without manual work;

- Allow notifications: helpful reminders about budgets and payments arrive directly on your phone, making financial routines easier to maintain consistently;

- Create a secure password: a strong password prevents unauthorized access and keeps your financial information protected against avoidable risks.

System requirements you should check first

Money Masters works on most modern devices, but checking storage space, version updates, and connection settings helps avoid delays and supports a better financial literacy experience.

- Check available storage: make sure your device has enough free space to install and run the app without slowing down or crashing;

- Verify operating system version: older software may not support updates. Updating your phone ensures full compatibility and stable performance across all app features;

- Confirm internet connection: a reliable Wi-Fi or mobile data connection guarantees a smooth download and allows real-time updates once the app is installed.

How the community of learners keeps you motivated

Learning feels easier when others are doing it too. Seeing progress, shared wins, and active users makes each lesson feel more connected to real life and personal goals.

The app’s active community supports long-term financial literacy by showing that progress happens step-by-step. Group challenges bring energy without turning it into competition.

Motivation builds naturally when lessons are part of a shared experience. Whether you’re ahead or catching up, it helps to know others are learning alongside you every day.

En rapport : Get free credit monitoring and fraud alerts with these apps

Turn five minutes a day into lifelong money skills

Building better money habits happens one step at a time. With the right tools, adults start making decisions that match their needs without second-guessing every expense.

This guide by Idées reçues was created to support adults with practical advice and tools that make financial literacy more approachable, useful, and part of everyday life.

For more ideas that simplify daily decisions, keep reading Insiderbits. You’ll find articles designed to help you build stronger habits and take control without added pressure.